While avoiding all risk in trading is impossible, there are definitely strategies you can employ to become a more controlled and confident trader. This article will equip you with valuable risk management techniques to navigate the markets and minimize potential losses.

1. Know Your Limits: Plan and Diversify

- Develop a Trading Plan: Before diving in, create a plan outlining your entry and exit points, risk tolerance, and investment goals. This plan should be based on research and a clear understanding of your chosen asset class.

- Diversify Your Portfolio: Don’t put all your eggs in one basket! Spread your capital across various assets to mitigate risk from any single security’s performance.

2. Embrace the Power of Stop-Loss and Take-Profit Orders

- Stop-Loss Orders: A stop-loss order automatically exits your position when the price reaches a predetermined level, limiting potential losses on a downward trend.

- Take-Profit Orders: Similarly, a take-profit order secures gains by automatically selling your asset when it reaches a desired price target.

3. Discipline is Key: Avoid Emotional Trading

- Stick to Your Plan: Emotions can cloud judgment. Follow your trading plan and avoid impulsive decisions based on fear or greed.

- Don’t Overtrade: Excessive trading incurs fees and increases the chance of making costly mistakes. Focus on high-quality trades aligned with your strategy.

4. Continuous Learning is Essential

- Stay Informed: The market is dynamic. Regularly research and stay updated on economic news, industry trends, and company performance to make informed decisions.

- Learn from Losses: Every trade offers a lesson. Analyze losing trades to identify weaknesses in your strategy and adapt accordingly.

Remember: Trading involves inherent risk. By employing these risk management techniques, you can increase your chances of success and become a more mindful trader.

Bonus Tip: Consider paper trading before risking real capital. Paper trading allows you to practice your strategies and get comfortable with the market dynamics without financial consequences.

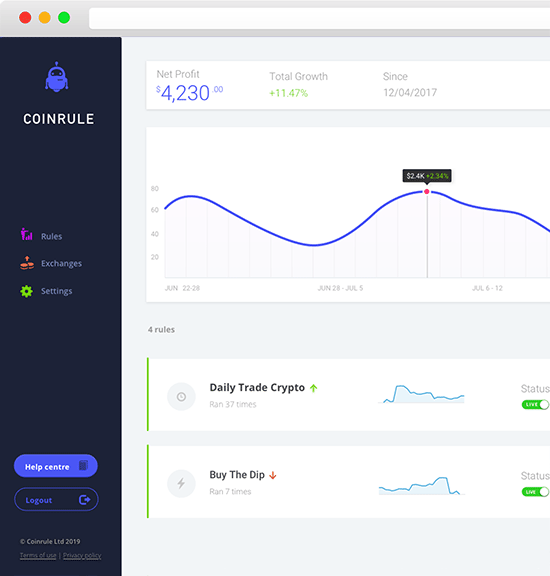

Before we conclude, let’s explore automated trading, try the sign up for free